by Rachel Garza

Gone are the days when people make payments of goods and services with physical cash. At that time, patronage of goods was restricted to buyers that are available to make payment physically. Nowadays, the payment of goods and services to merchants has been made easy due to technological advancement that has greeted the business and financial industry. People can now make a payment from the comfort of their couch. All these have been made possible because of the introduction of the credit card. With the credit card, buyers can make payment to merchants from all parts of the world. The introduction of credit cards is of immense benefit to merchants, banks, financial institutions, and other players in the business world.

Contents

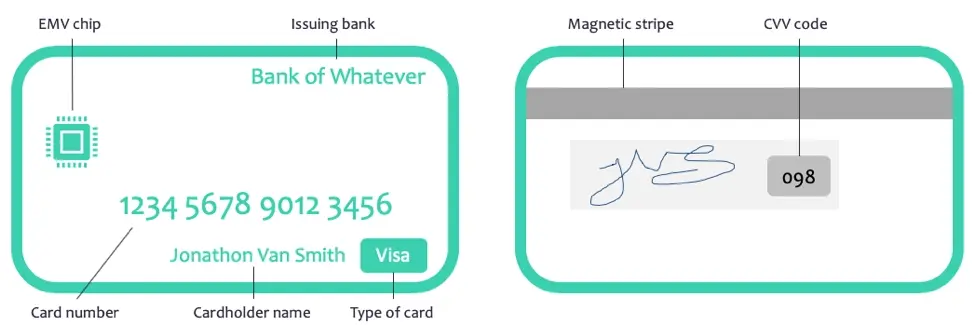

That said, credit card does not come in the form of plastic alone - it has some essential components that must be present and valid before you can enjoy its payment services. These details are unique to the issuer and holder of the credit card. As important as the details on the credit card is, not all cardholders understand their uniqueness and purpose of the numbers on their card. Therefore, today, I will be telling you all you need to know about the credit card numbers.

A credit card is a plastic payment card issued by banks or financial institutions to individuals. The payment card is used to make payment of goods and services to merchants and other players in the business world. As a credit cardholder, you can borrow money from banks or financial institutions to fund your credit card. You can use the borrowed money on the credit card to pay for goods and services online or at physical stores. However, most financial institutions or banks request for certain percentage as interest on the money you were borrowed to fund your credit card.

The credit card numbers are unique numbers that come with the credit card at the point of production and issuance. The numbers provide a lot of information when payment is made with the credit card. With the credit card numbers, you will obtain information about the financial institutions or banks that issued the credit card. It also gives information about the type of account you have with the issuer of the credit card. Hence, the credit card numbers highly essential for the functionality of the credit card.

As said earlier, the credit card number is an essential component that must be valid and verified before you can enjoy making a payment with your credit card. In this section, I will be dissecting the numbers and tell you what each number represents on your credit card.

Credit Card Issuer

The digits 1-6 are numbers that reveal the identity of the issuer of the credit card or bank identification number (BIN). Visit this BIN Checker App to test out various BIN numbers of different card netowrks

First Digit

The first digit on the credit card is also known as the Major Industry Identifier (MII). It represents the kind of network that produced your credit card. Each digit on the card has the industry it represents. These industries are highlighted below

The first digits on the credit card are different for each network. Each of the differences is elucidated in this section.

The table below summarizes the types of credit cards and their information provided by the numbers.

| Types of Card | Information Provided |

| Visa Cards |

|

| Mastercard Cards |

|

| American Express Cards |

|

1. Visa Cards: the digits two to six on the card represents the bank number. Digits 7-13 or 15 represents the account number of the cardholder. Also, digit 13 or 16 serves as the digit check on the visa card.

2. Mastercard Cards: the digits 2-3, 2 to 4, 2 to 5, and 2 to 6 represent the bank or financial institution number. The digits after the bank or financial institution number are stands for the account number of the cardholder. The last digit that is, digit 16, represents the check digit.

3. American Express: the digits 3 and 4 represent the type and currency of the card. The digits 5 to 11 stands for the account number of the cardholder. Also, digits 12 to 14 represent the card number, while digit 15 of the card number represents the digit check.

The credit card validity number is imprinted on the card at the point of production. The validity number gives information about the expiry month and year of the card. Once the expiry month and year is reached, the card will no longer be useful for business transactions. While making payment online, you will be asked to enter the validity period before the transaction can become successful.

The CVV, also referred to as card security code (CSC) is a vital component of the credit card. Without the CVV, no payment will be authorized or become successful. The CVV digits serve as a security check for the card by verifying and validating that you are the authentic holder of the credit card. The visa, discovery, and MasterCard cards have three-digit CVV while the American Express card has four digits CVV.

The credit card secret pin is one of the greatest features of the credit card. The card secret pin is private and must not be made public. The card pin is known to the cardholder only. It is requested when you want to make a payment with the credit card. Hence, it acts as a digital signature for payment authorization. Also, the pin is encrypted so that digital thieves and hackers will not be able to access it. Many a time, the card secret pin is made of four digits. As a cardholder, you must ensure that the four digits are easy to remember and difficult to guess by another person.

The magnetic stripe, also called, magstripe is a black bar that holds all your account information with the issuer. The magnetic stripe is made with a lot of tiny magnetic particles. When you use the card reader terminal to make a payment, it reads the magnetic stripe to identify your account number and other information about your account. The magstripe communicates with the bank so that your transaction can be authorized and processed. However, some issues can result in the inability of the card reader or ATM to accept your card. These issues include

1. The magnetic strips might have become scratched or dirty to be read.

2. When a magnet accidentally erased information on the magnetic stripe.

3. When the credit card's magnetic stripe is not working. In this case, you can contact your card issuer and place an order on another credit card. The replacement of the card may not attract charges because the error is from the issuer.

The introduction of the credit card has made business transactions easier for all and sundry. The credit card number is unique to each card. It must be valid, verified, and legal before any transaction can be processed. Today, I have discussed all you need to know about the credit card numbers. Please read through to get informed about the information provided to you by your credit card number.

About Rachel Garza

Rachel Garza is a passionate writer with a deep fascination for technology and science. Born and raised in an intellectually stimulating environment, she developed an early interest in exploring the latest advancements and breakthroughs in these fields. Rachel's love for writing and her insatiable curiosity led her to pursue a career as a tech and science writer.

|

|

|

|

Check These Out