by Rachel Garza

Money-making is keeping everyone busy nowadays. People are putting in their days and nights to earn a decent living. But what if I tell you that there are ways that let you make a handsome amount even without investing a lot of time into it! If you are curious to know, we got it sorted for you.

Contents

Have a look below to know more details:

Budgeting is the most crucial part of anyone's life nowadays who wants to save and earn money. If you are planning to earn more cash by your saved money, first you need to decide your budget. The budget is going to include everything from your needs to your wants and luxuries. Though your budget should be customized according to your spending pattern still, we can help if you are clueless. There are two ways experts advise you to design your budget. One way is the 50-30-20 rule. This rule says that 50% of your money should be spent on needs. Needs include the bills, grocery, insurance, rents, medical costs, etc. whereas 30% should be spent on wants. Wants refer to luxuries like shopping, eating out, a spa day, recreation, etc. The last 20% is savings . It is the money you decide to keep away as saving no matter what. The other rule is the 70-20-10 rule . It says that 70% of earning should be spent on all the expenses. 20% of the money goes to saving, and the rest 10% goes to debt. So, you can decide which rule is best for you.

Making a budget is not difficult, but keeping track of it is! Our human brain sometimes tricks us into spending money at random places, and we end up disturbing the budget. The best way to keep track of your budget is to link your ATMs and accounts to an online budgeting app and manage your finances accordingly. If you have not tried any of the online budgeting apps yet, download YNAB for iOS or Android. YNAB gives you a 34-day free trial and color codes your expenditures for easy tracking.

All of us deal with one or the other kind of debts in our life, be it student loan or credit card or any other kind of debt. But some of us just let go of the debts and keep delaying them. But this only adds to the burden of money. It's simple, every dollar you pay back, saves you from further interest on that money. In easier words, paying down the debt faster means more money in the account earlier.

Conventional business wisdom says that credit cards should be avoided, but there's a caveat. Some cards reward you with points, cash back, and gift cards on your purchases from different brands. If you pay your balance each month on time, you can save a lot of money. If you get cash backs, it makes you can make more purchases free-hand, and if not, gift cards and vouchers can help with paying bills, which is great itself!

Almost all of us have saving accounts to put our savings, but how much interest do they yield? If you are supposed to have a savings account anyhow, why not invest in something that gives you more revenue at the same time. Usually, the bank accounts provide very little interest in minimal amounts; the most you can avail is around 2%. This interest rate is offered by the high yield accounts only, so open up high yield savings account in a bank with a higher interest rate.

401k is an excellent option for investment if you want tax exemption on your earnings. 401k is a retirement program that lets you earn tax-free until the age of retirement i.e., 59.5

401k is an employer-sponsored retirement plan. This means that if you contribute a certain percentage of money, y our employer will match your contribution, and you earn from all of the capital. Learn more about 401k here.

Real estate is not an excellent business option owing to the statistics of prices of houses over the years, but it is not a bad business either. The good part is that there are very fewer chances of the costs of homes to drop. You might experience a less increase in the prices, though. Over the past 20 years, statistics show that the annual growth rate of real estate prices is 4% , which falls to 3% in the case of inflation. Though, another utilization of real estate business can be rent-outs. But don't forget the terms and conditions that come with the advantage of being the landlord.

Stocks are an excellent means of earning if you want to make even while sleeping. Investing in the right kind of stock can result in high revenue over time. If you have put money in your savings account, this is the right time to take some out of it and invest in the right stocks. One of the simplest ways is to initially invest in a low fee, broad market index fund. Another worth-noting thing is that many stocks, broad index funds, too, pay dividends. Dollars invested in dividend-paying stocks will generate regular payments for you. You can now invest in stocks online too.

Let's show you a comparison of 2% growth (High yield savings account) and 8% growth (stock market)

| Progress for $10,000 invested annually | Growth at 2% | Growth at 8% |

| 10 years | $111,687 | $156,455 |

| 15 years | $176,393 | $293,243 |

| 20 years | $247,833 | $494,229 |

| 25 years | $326,709 | $789,544 |

| 30 years | $413,794 | $1.2 million |

Another option for getting money without effort is buying bonds. There are various kinds of bonds of different values with different interest rates. US government issues bonds in the name of Treasuries by the Treasury department. Local governments also issue municipal bonds that are free of federal taxes . Other than these, corporate bonds are also available. If you are looking for reliable bond options, junk bonds might not be your choice. Those bonds feature different interest rates to lure investors into choosing an interest plan according to your risk.

Here are the recent treasury rates:

| Treasury | Yield |

| 3 months | 2.38% |

| 6 months | 2.51% |

| 1 year | 2.66% |

| 2 years | 2.80% |

| 5 years | 2.89% |

| 10 years | 3.06% |

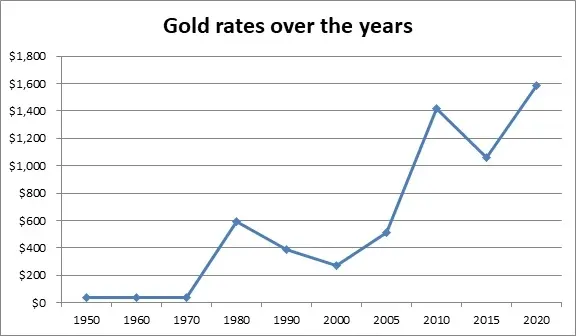

Gold is a prevalent mode of investment among people who have been in the business. Gold is a good option as the prices usually rise, but you cannot consider it to be a permanent source of income in the long run. Gold is volatile too. You can never tell when the prices would fall suddenly. So always invest in gold at a lower risk, so you don't lose a lot in the end. Let's have a look at how the gold prices have hiked up and down all the way.

Annuities are a great passive income option for those who have low-risk tolerability . As they always say, high profits come with higher risks. So it must be self-evident that Annuities do not give you a high amount back. It is a type of insurance product that you have to buy once, but it pays you monthly for the rest of your life. You can also add your spouse as a recipient to that money or guarantee that inflation would not cause a decrease in the monthly amount .

Doesn't it look perfect? It can be an excellent way to earn money without doing anything if your partner is a trustful contact. You can be a sleeping partner with anyone who runs a business. By sleeping partner, what you do is that you invest the larger amount or all of it, and the other person puts their effort and time. By putting money, you are saving your time and effort. In such a business, the business partners decide the terms and conditions according to their feasibility. So if you find such a person, you can get the monthly profit without even having to do anything.

We already talked about renting up our place when we talked about real estate. However it is not necessary that you lend it to someone who lives in your city or you rent it directly. There is an increased demand of rooms and rest houses if you live in an area that caters to plenty of tourists. People coming from other countries and cities look for cheap rooms and apartments. So let's assume that you rent your room every month for 20 nights, charging a minimal $100 per night. You make $2000 straight away! And if you rent out the whole of your house in high-season, you can get up to $2000 per week! That's not at all a bad deal for no such effort. You can also connect yourself to Airbnb and make your place reachable to more people looking for a room at lower prices.

These are some of the many ways of making your money work. By investing money, you earn without putting any effort, which saves you time and energy for something else meanwhile. And it is also better than your money sitting in the bank. Understand your kind of investment and smartly invest money to get the most benefit out of it!

About Rachel Garza

Rachel Garza is a passionate writer with a deep fascination for technology and science. Born and raised in an intellectually stimulating environment, she developed an early interest in exploring the latest advancements and breakthroughs in these fields. Rachel's love for writing and her insatiable curiosity led her to pursue a career as a tech and science writer.

|

|

|

|

Check These Out